Categories

- Audit

- Builders Risk

- Business Auto

- Carriers

- Certificate of Insurance

- Computer Technology

- Construction Defect

- Contractors Pollution Liability

- Court Rulings

- Employment Practices Liability

- General Liability

- Green Building

- Health Care

- Home Inspectors

- Home Owners Warranty

- Idemnification / Hold Harmless

- Insurance Audit

- News

- Pollution

- Remodeling

- Resourceful Information

- Risk Management

- Sadler Client Profile

- Workers' Compensation

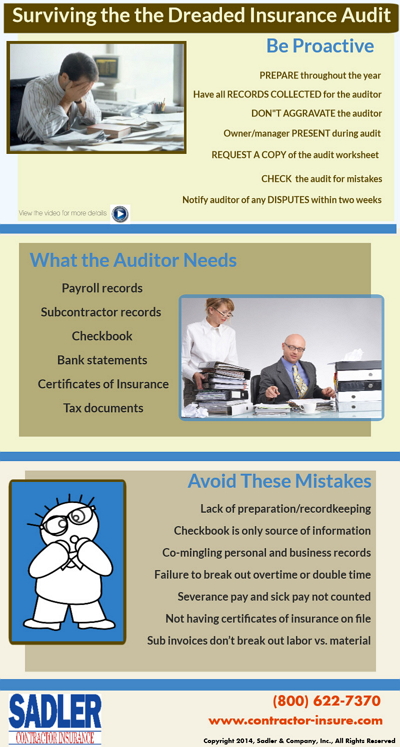

Surviving Your Insurance Audit

What contractors need to know BEFORE the auditor arrives

Insurance audit. Just these simple words can trigger very negative emotions for a contractor! In this blog I will attempt to help prepare you for your next Workers Compensation and/or General Liability audits.

To begin, both of these policies are based on estimated numbers (employee payroll, uninsured sub payroll, amounts paid to insured subs, gross receipts, etc.) since you don’t know exactly what they will be at the end of the policy term. Usually you will be contacted by the auditor 30 to 45 days after the expiration of the policies requesting an appointment to meet with you and review your records.

The insurance auditor will want to review the following:

- W-2s (employee payrolls)

- 1099s (subcontractor payrolls)

- Ledger statements

- Certificates of insurance on your subcontractors

- Job duties of your employees and subcontractors to make sure that they are properly classified according to insurance rules and regulations

The next step

After the insurance auditor meets with you and reviews the above information, he will go back to his office and count the beans to determine whether you overpaid or underpaid your premiums. He will then send his report to the insurance company. Depending on the outcome, you will either receive a return premium or additional premium invoice along with a copy of the audit worksheets. Please be sure that you understand audit additional premiums are due and payable in full within 30 days of the audit, unless it’s being disputed.

Due to confidentiality laws, your insurance agent will not be given a copy of the audit worksheets unless you give your permission during the audit. I strongly recommend you give your permission. If you do dispute your audit you will need your agent’s help during the process. Without the audit worksheets there won’t be much we can do for you.

Tips for setting the tone

When the insurance auditor arrives at your office I recommend that you have a comfortable, quiet place for them to work, and have all of your paperwork ready and organized. Make sure that the person who is to meet with the insurance auditor has cleared their calendar so they won’t be interrupted with phone calls, office meetings, etc. Treat the auditor as a respected guest and not as the “enemy” — offer them the same amenities you would offer to any other guest. Remember, they are people too and are there to do their job. I’ve dealt with many insurance auditors, and their main complaints are that when they get to their appointment the records, people, place to work, etc. are not available and the insured was rude. Their negative impressions may not be the “whole story”, but it can make a difference. Believe me when I tell you they don’t want to be in your office any longer than absolutely necessary!

-

Recent News

- Post-recession Homebuilding Market on the Rise

- Collecting Certificates of Insurance from Subcontractors

- How to Properly Deduct from Uninsured Subcontractors

- Construction Defects and Mistakes

- Why Join a Home Builder Association?

- Workplace Safety Policy Includes a Return-to-Work Plan

- Will drones work with insurance claims adjusters?

- Builder’s gross negligence ends in $20.8 million award

- Surviving the dreaded insurance audit (Infographic)

- Architect jailed for improper fireplace installation

- Safety Costs to Soar Over New OSHA Regulations

- Home Inspector Dodges Liability

- Common Respiratory Dangers on Construction Jobsites

- Building Design Impacts Slip/Trip/Fall Hazards

- Contractors On Job Heat Illness

- Invalid Insurance Leads to Lawsuit in Building Collapse

- Sadler Client Profile: Top Hat Sweepers

- Beware Hold Harmless and Indemnification Provisions

- A Case for HBW 2-10 Warranty

- Top Traffic Ticket Excuses