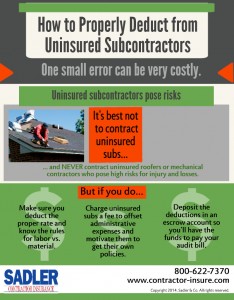

Properly Deduct From Uninsured Subs

The next tip is that you must know how to properly deduct or withhold from your uninsured subs in order to recoup the cost of providing their Workers’ Compensation insurance. There are several rules about labor versus materials that you need to be aware of to properly deduct.

The next tip is that you must know how to properly deduct or withhold from your uninsured subs in order to recoup the cost of providing their Workers’ Compensation insurance. There are several rules about labor versus materials that you need to be aware of to properly deduct.

For example, you always want the invoice to break out labor versus materials so that you are charged only for the labor portion. However, if the invoice does not break out labor and materials, auditors have wide discretion in determining the labor charge. Most will assume that 50% or more of the total amount is attributable to labor. However, if heavy equipment is provided as part of the job, the auditor may assume that only 33% is attributable to labor. Your insurance agent should provide a withholding sheet that indicates the proper rate to deduct for each classification of uninsured sub.

See the “Deducting From Uninsured Subs” main article section for more on the topic of how to properly deduct from uninsured subs.